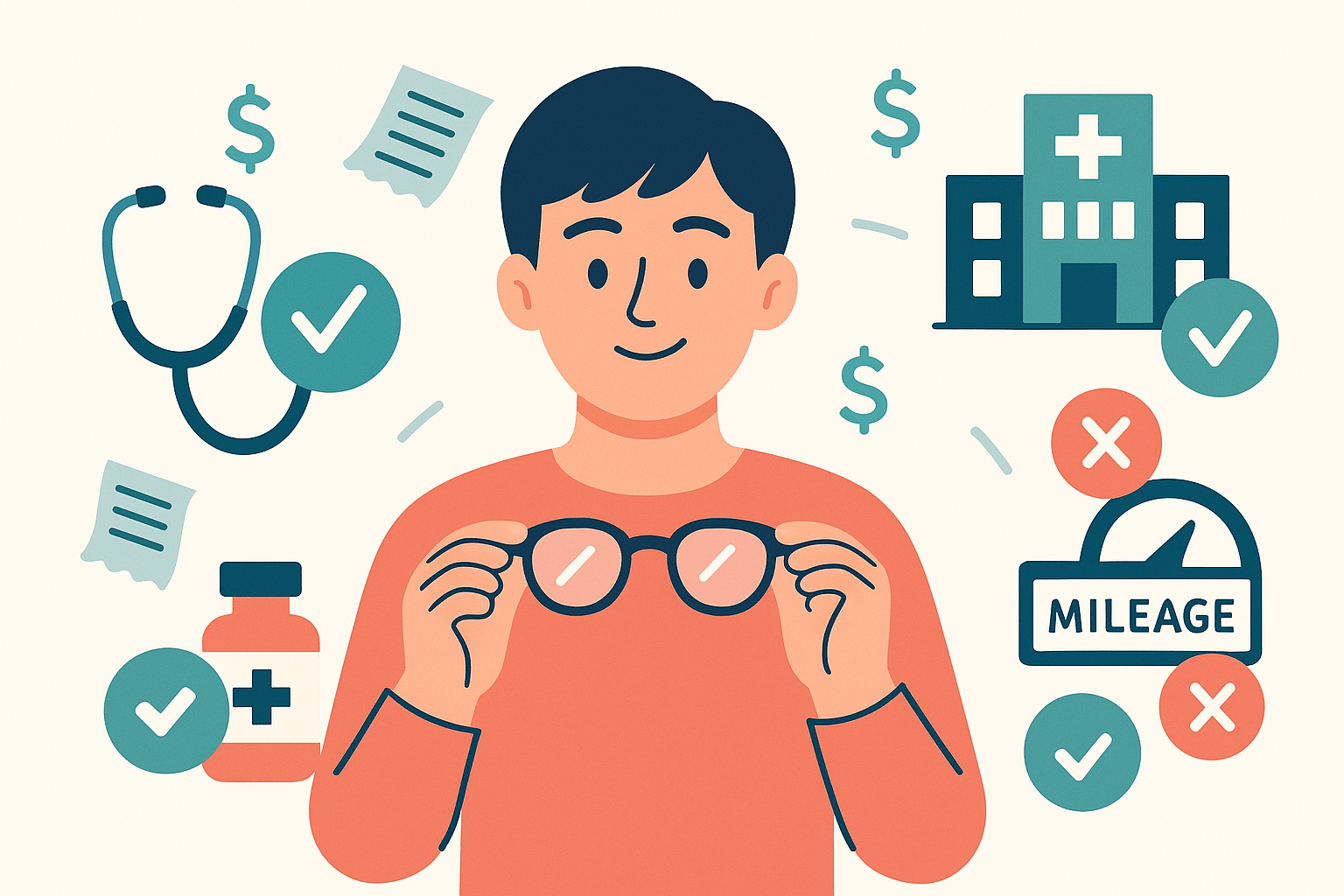

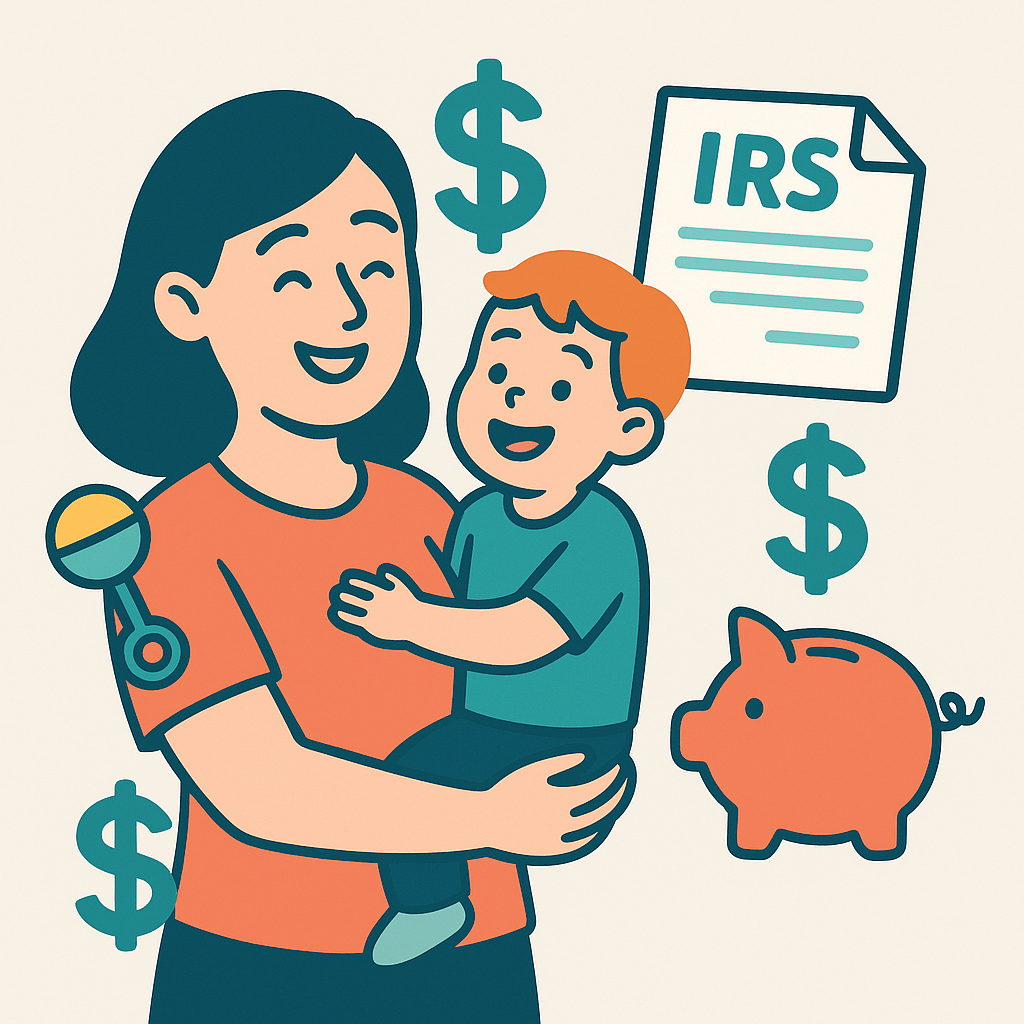

Doctor visits, prescriptions, surprise ER bills — healthcare isn’t cheap. But here’s a small silver lining: some medical expenses may be deductible on your taxes.

And yes, even those new glasses might count.

The Basics

You can deduct certain medical expenses if they’re more than a set percentage of your income (check the current IRS rules for the exact threshold). That means not every copay makes the cut, but bigger bills could.

What Usually Counts ✅

- Doctor and dentist visits

- Prescription medications

- Glasses, contacts, and even prescription sunglasses

- Surgeries and hospital stays

- Health insurance premiums (if not covered elsewhere)

- Medical equipment (crutches, wheelchairs, etc.)

- Travel for medical care (mileage, parking, tolls)

What Usually Doesn’t Count ❌

- Over-the-counter meds without a prescription (yep, even ibuprofen)

- Cosmetic procedures that aren’t medically necessary

- Gym memberships (unless prescribed for a diagnosed condition)

- Vitamins and supplements (except if prescribed)

Pro Tips

- Save receipts and statements throughout the year.

- Track medical mileage — every trip to the doctor adds up.

- Account for reimbursements — you can’t deduct what insurance already covered.

- 👉 Easiest way: Use our free Expense Tracker to snap receipts, log prescriptions, and record mileage in seconds. No shoebox, no spreadsheets, no stress.

Bottom Line

If your medical bills stacked up this year, you may be eligible for a tax break. And yes, those prescription glasses qualify too.

👉 We’ll help you figure out what counts and maximize your deductions. Book in 2 minutes → makeadultingeasier.com/book

General information only — confirm with current IRS guidance or a tax professional.