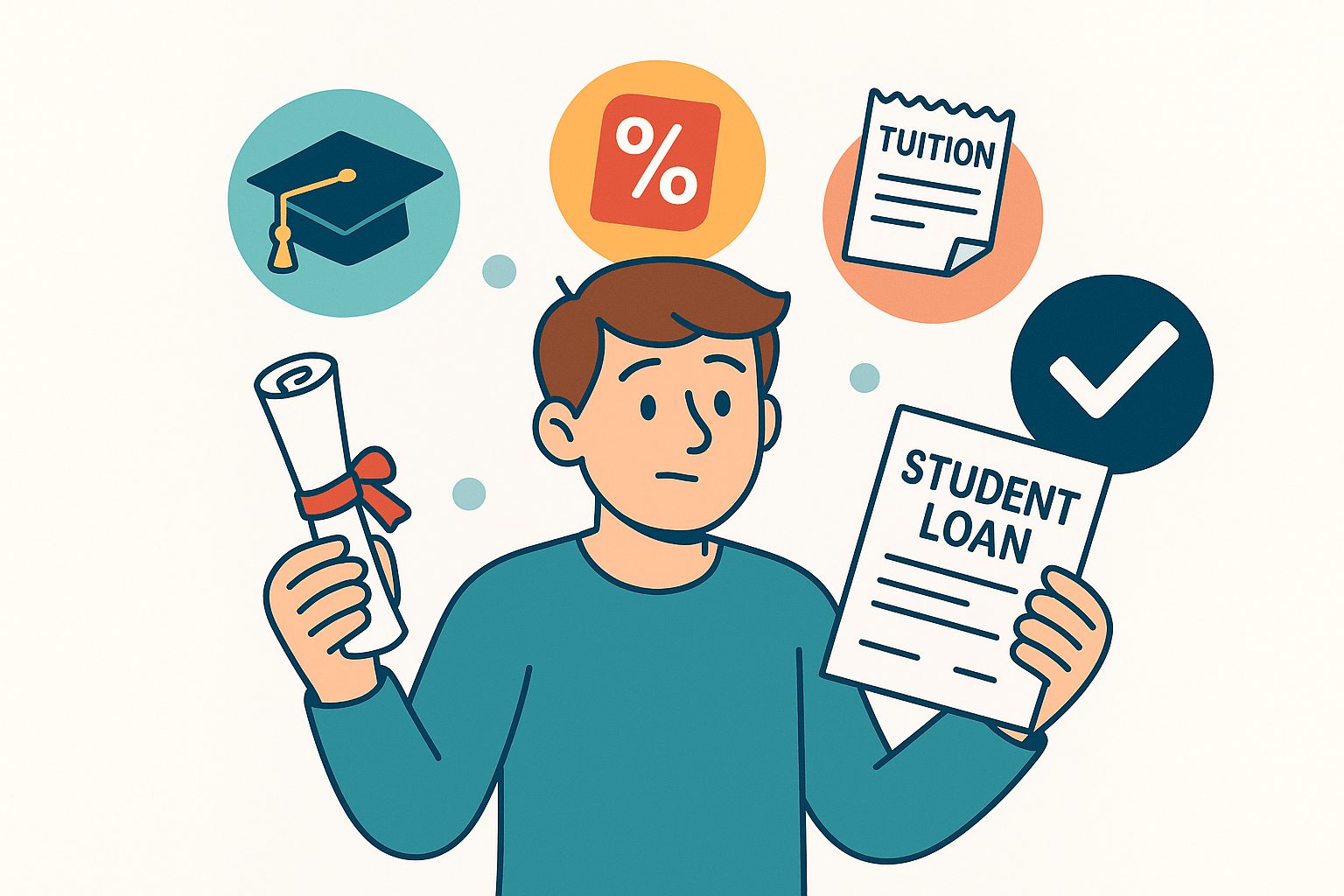

Having kids changes everything — including your taxes. The good news? The Child Tax Credit can put real money back in your pocket.

No IRS dictionary needed — here’s what it means in plain English.

What It Is

The Child Tax Credit is designed to help parents cover the costs of raising kids. Think of it as the IRS saying: “Hey, kids are expensive, here’s a break.”

Who Qualifies

You may be eligible if:

- Your child is under 17 at the end of the tax year.

- The child lives with you for more than half the year.

- They’re your dependent (meaning you provide most of their support).

- They have a valid Social Security number.

Income limits apply, so higher earners may get reduced amounts.

How Much It’s Worth

The credit amount can change from year to year — and sometimes mid-year (thanks, Congress). Check the latest IRS guidance for the current numbers.

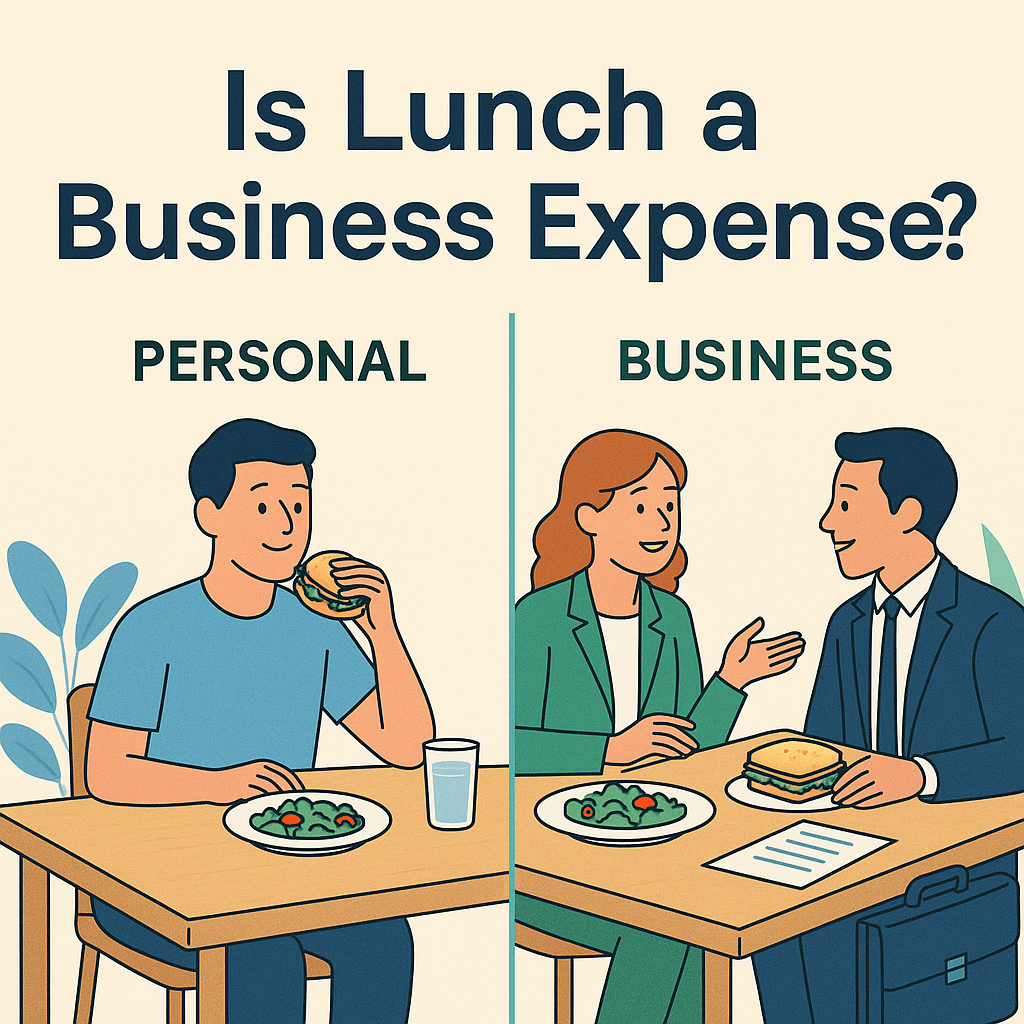

Refundable vs. Nonrefundable

- Refundable credit: If the credit is more than your tax bill, you can get money back.

- Nonrefundable credit: It only reduces what you owe, nothing extra.

- The Child Tax Credit is partly refundable — meaning in some cases you can get a refund even if you don’t owe taxes.

Why It Matters

Even if you don’t think you owe much, the Child Tax Credit could boost your refund or lower your tax bill. It’s one of the biggest credits available to parents.

Bottom Line

Kids are expensive. Don’t miss out on the Child Tax Credit — it could mean extra cash back at tax time.

👉 We’ll help you claim every credit you qualify for. Book in 2 minutes: makeadultingeasier.com/book

Disclaimer: General information only — confirm with current IRS guidance or a tax professional.