Nothing kills the refund buzz like finding out you owe the IRS instead. You file your return, expecting money back — but instead, the screen says “Amount Due.”

Why does this happen, and how can you avoid it next year?

Common Reasons You Owe Taxes

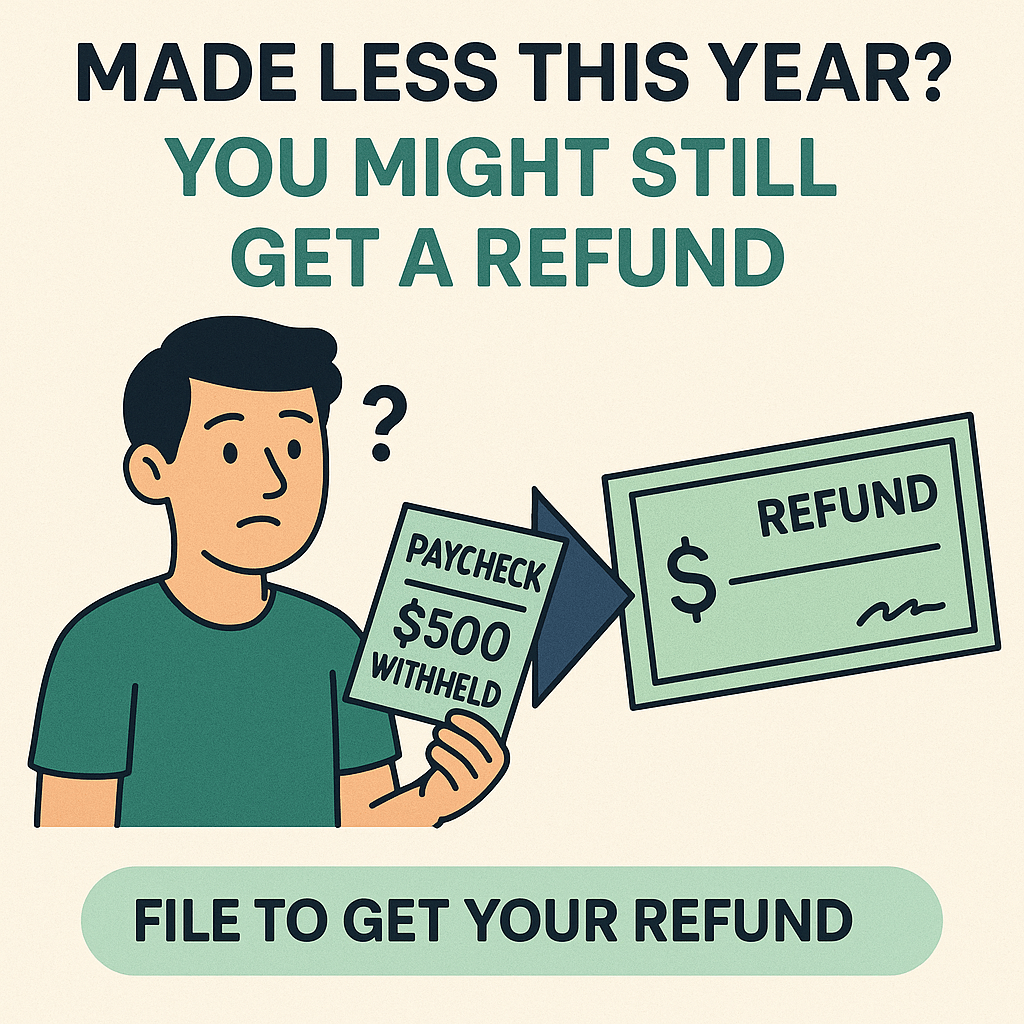

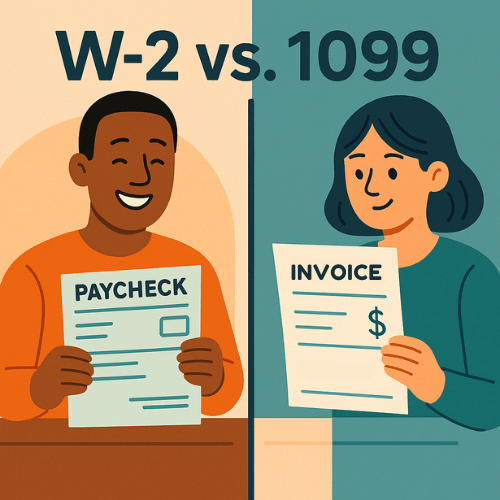

1. Withholding Was Too Low

If your employer didn’t withhold enough from your paycheck, you’ll have to make up the difference at tax time. This often happens when:

- You started a new job and didn’t update your W-4

- You claimed “single” or “married” incorrectly

- You had multiple jobs but didn’t adjust for extra income

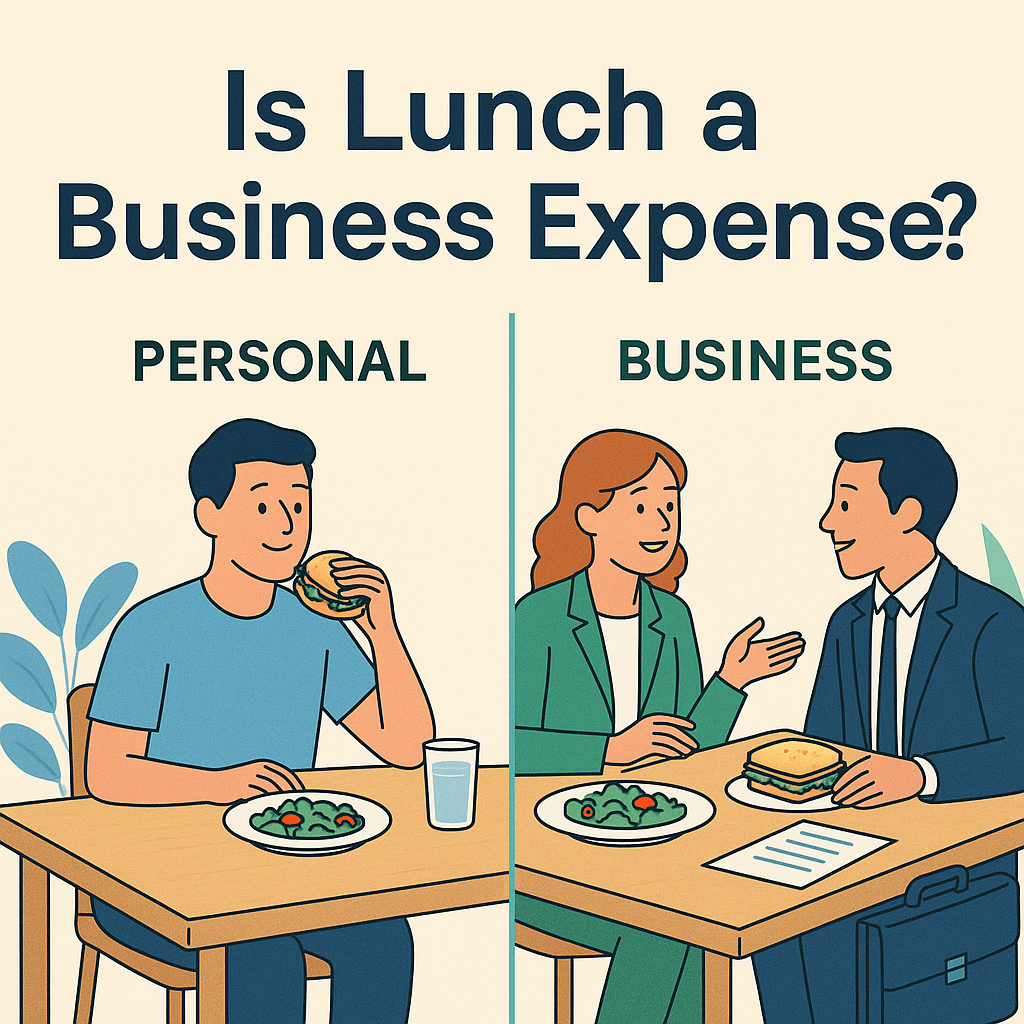

2. Side Hustle or Freelance Income

That cash from Uber, Etsy, or freelance work? Taxes aren’t automatically taken out. If you didn’t pay estimated taxes during the year, you may owe now.

👉 Pro tip: Use our free Expense Tracker to log side hustle income, upload receipts, and calculate what to set aside for quarterly taxes. It takes minutes — and saves you from a big April surprise.

3. Life Changes

Got married? Had a baby? Bought a house? Big life shifts can change your tax situation — and sometimes your refund expectations.

4. Tax Credits/Benefits Changed

Credits like the Child Tax Credit and Earned Income Credit can shift year-to-year. If you were counting on them and they dropped, that can flip a refund into a balance due.

How to Avoid the Surprise

- Update your W-4: Adjust through your employer so the right tax is withheld.

- Make quarterly payments: Side hustle income? Set aside a portion and send it to the IRS every few months.

- Use last year as a guide: If you owed before, tweak things now.

- Talk to a tax pro: We’ll help you find the right mix of withholding and estimates.

Bottom Line

Owing taxes isn’t a sign you did something “wrong” — it just means not enough was paid in during the year. The good news? With small adjustments (and better tracking), you can avoid the surprise next time.

👉 Skip the stress and fix it before next year. Book in 2 minutes → makeadultingeasier.com/book

General information only — confirm with current IRS guidance or a tax professional.