Backpacks? ✔️

Lunchboxes? ✔️

New sneakers? ✔️

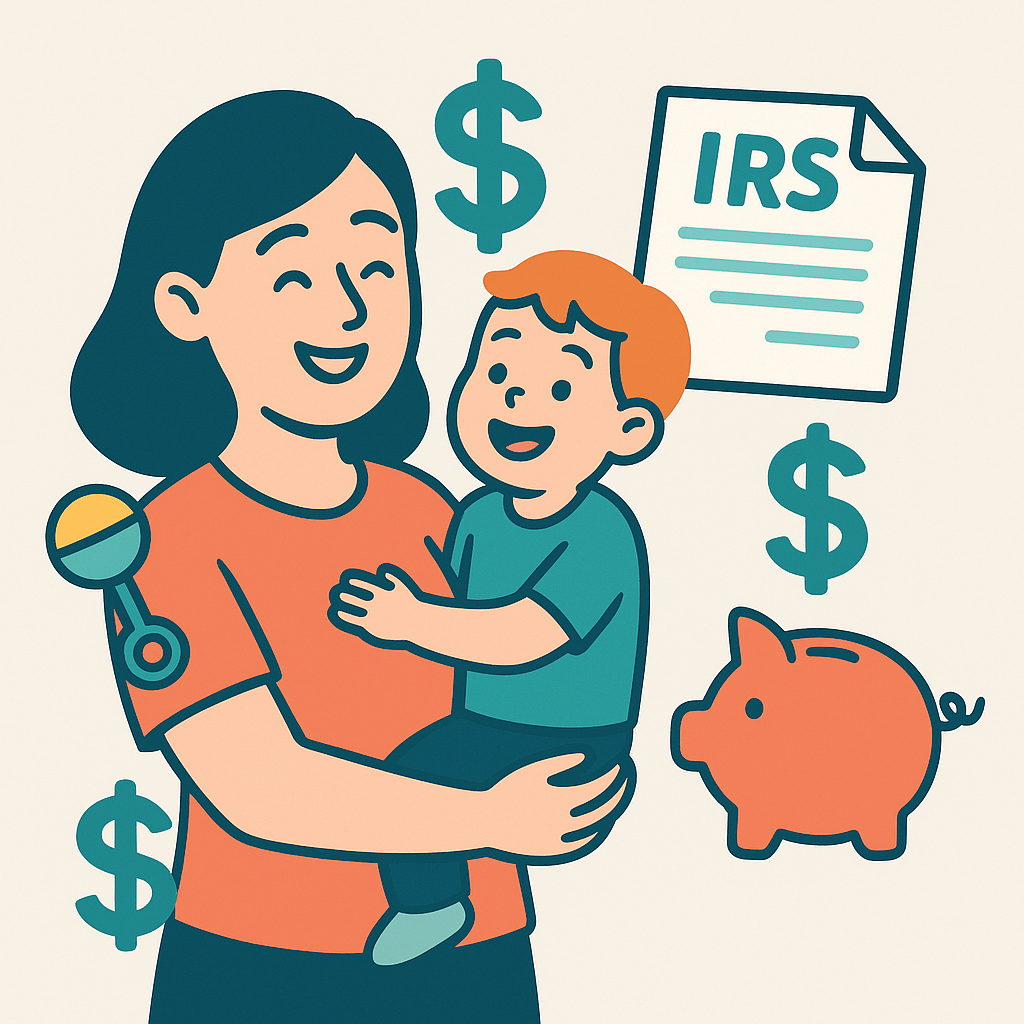

Remembering that school costs could lower your taxes? …Not on most parents’ lists.

But they should be. If you or your kids are hitting the books, you might qualify for valuable education tax credits. Let’s break them down.

The Two Big Education Tax Credits

1. American Opportunity Tax Credit (AOTC)

- For the first four years of college

- Covers tuition, fees, and course materials

- Partially refundable (you could get money back even if you don’t owe)

2. Lifetime Learning Credit (LLC)

- For any post-high school education — college, grad school, even job training

- No year limit — you can use it as long as you’re paying eligible expenses

- Not refundable (only reduces what you owe)

Who Can Claim These Credits?

You may qualify if:

- You, your spouse, or your dependent paid eligible education expenses

- The student is enrolled at an eligible institution

- You meet income limits (these change yearly — check the latest IRS rules)

⚠️ Heads up: You can’t claim both credits for the same student in the same year.

What Counts as “Education Expenses”?

✅ Tuition + required enrollment fees

✅ Books, supplies, and equipment needed for coursework

❌ Room and board (dorm life doesn’t count)

Common Mistakes Parents Make

- Both parents claiming the same student (only one return gets the credit)

- Forgetting the 1098-T form (schools send this — don’t toss it with junk mail)

- Ignoring income limits (you might phase out if earnings are above the cutoff)

Pro Tip: Keep Everything in One Place

Lost receipts = lost credits. Use our free Expense Tracker to upload your 1098-T, log tuition payments, and save supply receipts as you go. No scrambling at tax time.

Why It Matters

Education credits can mean up to a couple thousand dollars in savings. That’s money for school supplies, loan payments, or just a little breathing room.

Bottom Line

Back-to-school season isn’t just about supply lists — it’s your reminder to track education expenses and claim every credit you’re eligible for.

👉 We’ll help you sort through credits, forms, and eligibility so you don’t leave money on the table.

Book in 2 minutes → makeadultingeasier.com/book

General information only — confirm with current IRS guidance or a tax professional.