Many new influencers think: “If I buy it for Instagram, it’s deductible.” That designer outfit? Deductible. That beach trip you vlogged? Deductible.

Not exactly.

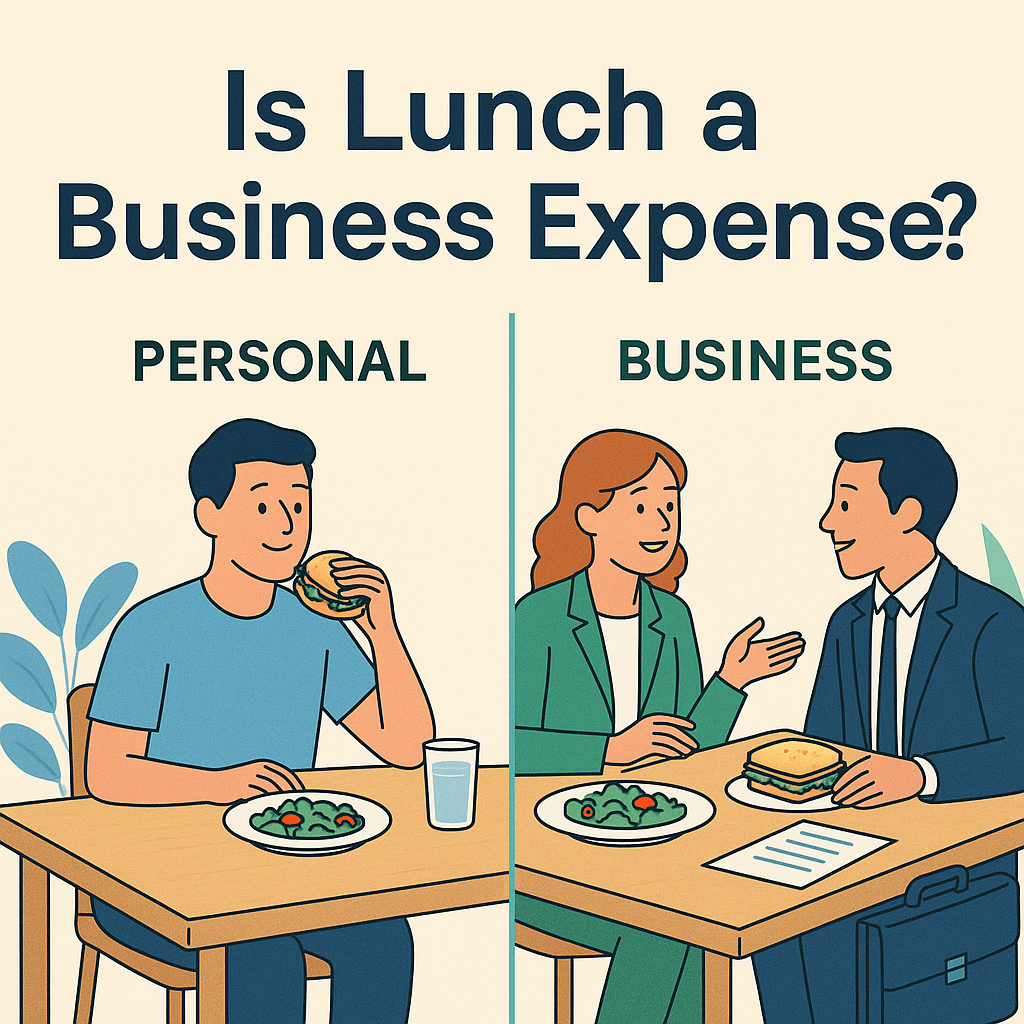

The Reality: Everyday vs. Business Expenses

The IRS only allows deductions for expenses that are:

- Ordinary → Common in your line of work

- Necessary → Helpful for generating income

Translation: you can’t write off your whole lifestyle just because it looks good online.

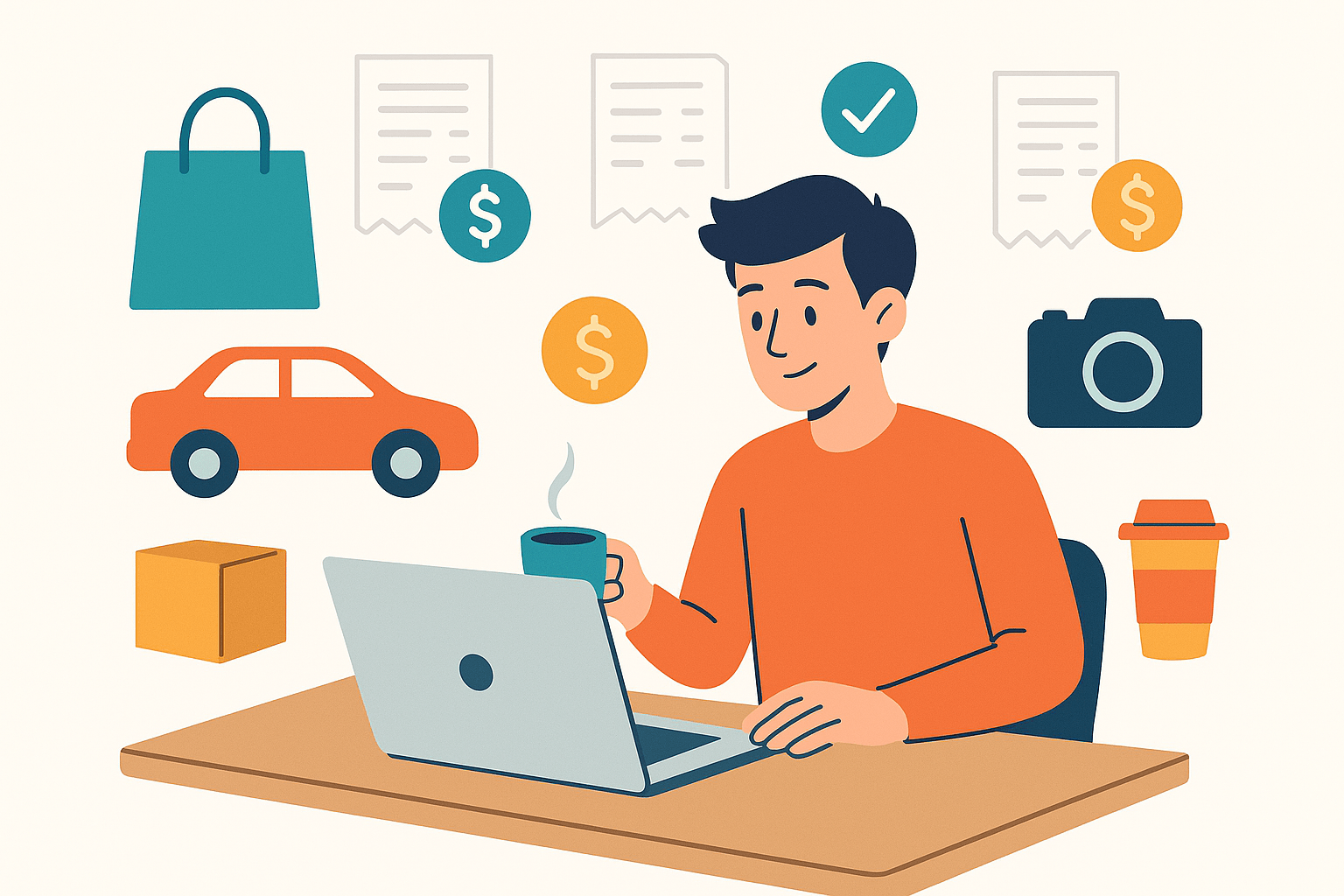

What Influencers Can Deduct

- Props, costumes, or clothing that cannot be used as everyday wear (e.g., branded merch, costumes, stage makeup)

- Cameras, lighting, editing software

- A portion of phone and internet bills (for content work)

- Travel expenses if the trip is primarily business-related (shooting content, attending a brand event, etc.)

- Contractor fees (photographers, video editors, etc.)

👉 Stay audit-proof: log purchases in real time with our free Expense Tracker.

What Doesn’t Count (Nice Try)

- Everyday clothes, makeup, and skincare you also use outside of content

- Personal vacations where you “happen to post”

- Rent, groceries, or general living expenses

If it doubles as personal use, the IRS says nope.

Quick Example

Ava buys a $500 cosplay outfit she wears only in YouTube videos. ✅ Deductible.

She also buys a $500 Zara blazer she wears both in content and to brunch. ❌ Not deductible.

Bottom Line

Influencers can deduct real business costs—gear, props, business travel—but not their entire lifestyle. The line comes down to “business-only” vs. “personal use.”

General information only—confirm with current IRS guidance or a tax professional.

👉 Want to be sure you’re writing off the right stuff?

- Track your purchases now with our free Expense Tracker.

- Book your tax prep in 2 minutes: makeadultingeasier.com/book