The Myth: You Need a Separate Room

The classic line goes: “You can only deduct a home office if you have an entire room dedicated to work.”

That myth has kept a lot of people from even trying. The good news? The rules are a little more flexible.

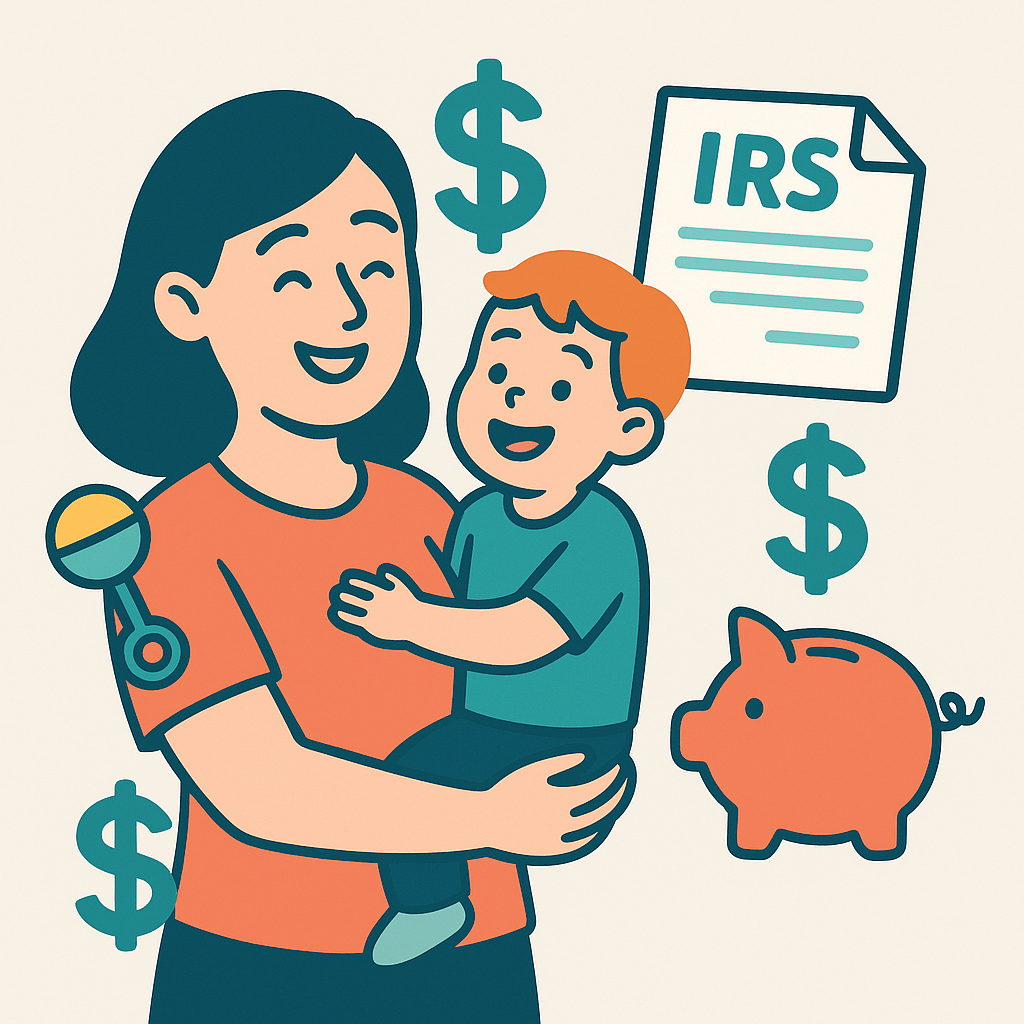

The Reality: IRS Rules for Home Office Deductions

Here’s the actual standard:

- Your home office space must be used regularly and exclusively for business.

- It doesn’t need to be a whole room. A section of your living room or a corner of your bedroom can qualify—as long as you don’t also use that same space for personal stuff.

So, if your laptop lives on the kitchen table where you also eat tacos? Nope. But a dedicated desk in the corner? Possibly yes.

Simplified Option vs. Regular Method

There are two ways to calculate the deduction:

- Simplified option: $5 per square foot, up to 300 sq. ft. (max $1,500 deduction).

- Regular method: Deduct a percentage of actual expenses (utilities, rent, mortgage interest, insurance).

The simplified version is easier, but the regular method can sometimes save more if your expenses are high.

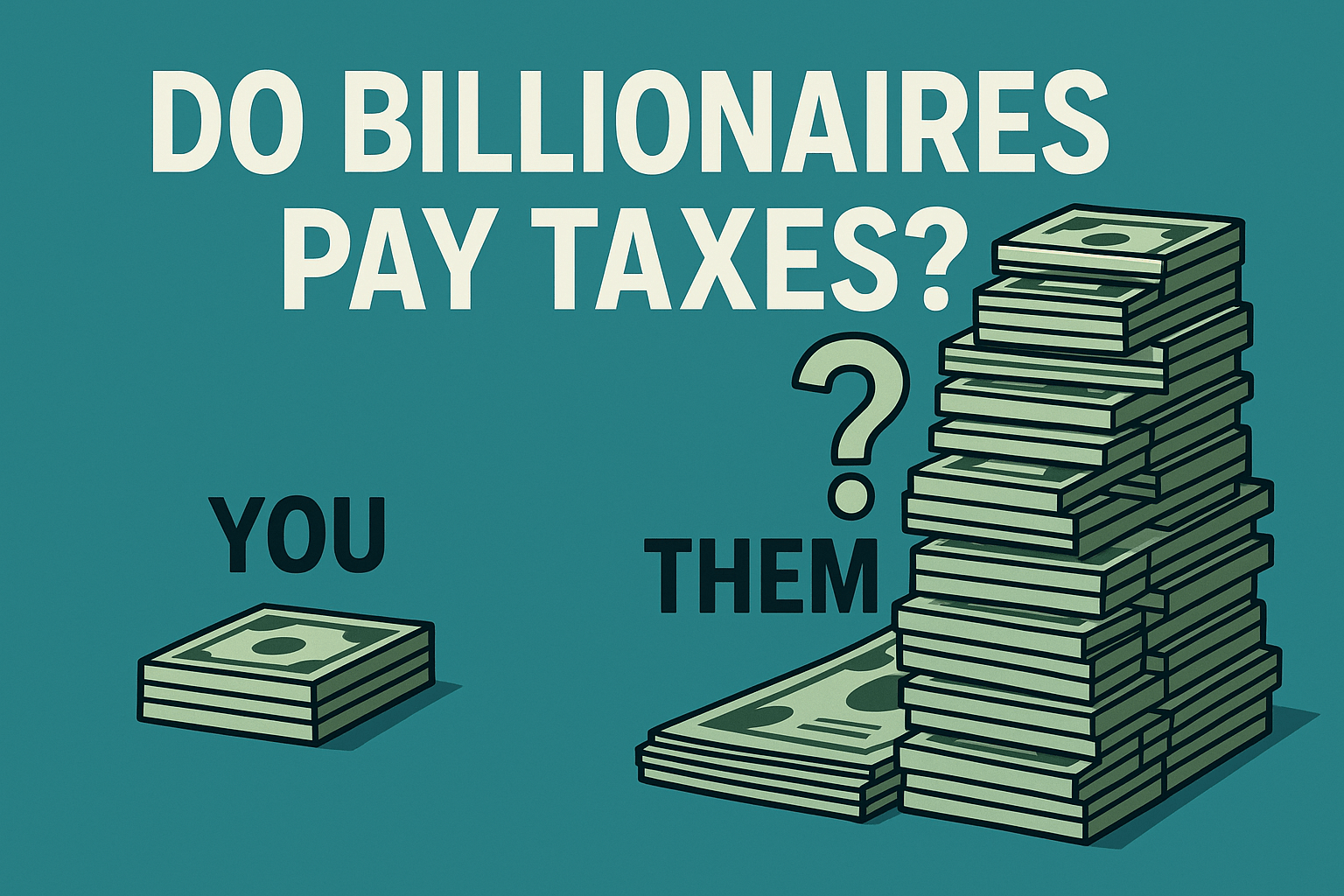

Who Qualifies (and Who Doesn’t)

- Qualifies: Self-employed workers, freelancers, small business owners.

- Doesn’t qualify: W-2 employees who work remotely (the Tax Cuts and Jobs Act suspended that deduction until at least 2025).

Quick Example

Chris runs a freelance graphic design business from a desk in his spare bedroom. The space is used only for work. He can take the home office deduction.

Taylor, on the other hand, works from the kitchen counter for her W-2 job. Unfortunately, that space—and her status as an employee—don’t qualify.

Always make sure you track your expenses with our free Expense Tracker.

Bottom Line

You don’t need a separate room for the home office deduction—you just need a space used regularly and exclusively for work.

General information only—confirm with current IRS guidance or a tax professional.

👉 Got mixed W-2 and side hustle income? Let us sort it out.

Book your return in 2 minutes: makeadultingeasier.com/book