If you’re asking this question, you’re already ahead of the game. Most people wait until the last minute to panic — you’re doing it right by figuring it out early.

The short answer: maybe. Whether you need to file depends on your income, age, and filing status. And if you had a side hustle, new baby, or bought your first house, the answer leans even more toward “yes.”

The Basics

You typically have to file a federal tax return if:

- Your income is above the IRS filing threshold for your age and filing status.

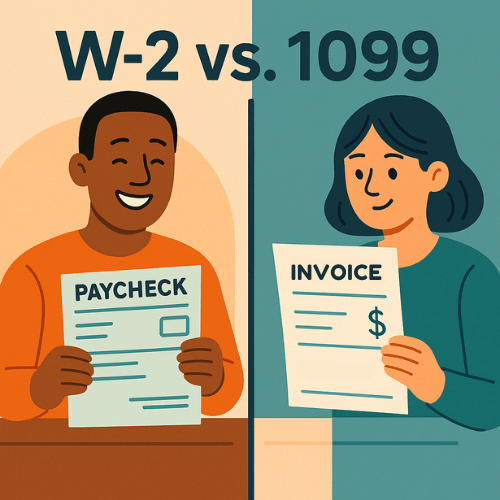

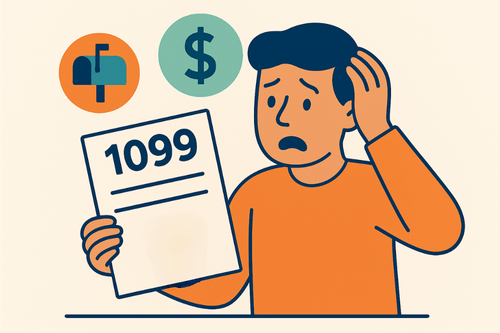

- You had self-employment income of $400 or more (gig work, freelancing, DoorDash, etc.).

- You received 1099 forms for side work, tips, or contract jobs.

- You owe special taxes (like early retirement withdrawals).

IRS Filing Thresholds (Tax Year 2024)

If your gross income was at least the amount below, you generally need to file:

| Filing Status | Threshold (under 65) |

|---|---|

| Single | $14,600 |

| Married Filing Jointly | $29,200 |

| Head of Household | $21,900 |

If you’re 65 or older, the threshold is a bit higher:

- Single, 65+: $16,550

- Head of Household, 65+: $23,850

- Married Filing Jointly, if one or both spouses are 65+: thresholds range from $30,750–$32,300

Thresholds change every year due to inflation adjustments. Always check the latest IRS chart or confirm with a tax pro.

And remember: even if your income is below these numbers, if you earned $400 or more from self-employment, you still need to file.

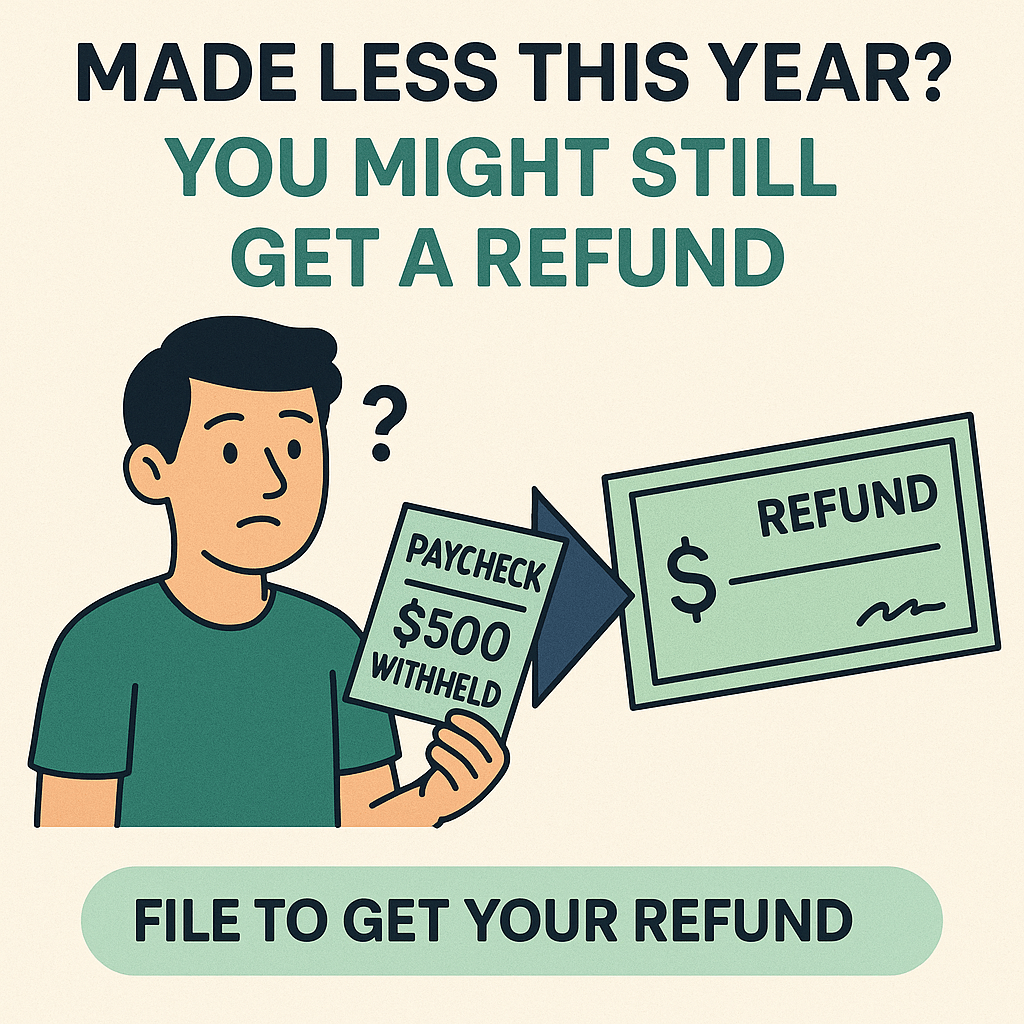

Even If You Don’t Have To File…

You might want to anyway. Why?

- Refunds. If you had taxes withheld from paychecks, you only get that money back by filing.

- Credits. Child Tax Credit, Earned Income Tax Credit, education credits — filing unlocks them.

- State taxes. Your state might still require a return even if the IRS doesn’t.

Skipping a return could mean leaving money on the table. And who likes giving the government a tip?

Life Events That Change Things

You should definitely double-check your filing status if you:

- Got married (congrats — but “married filing jointly” changes your thresholds).

- Had a baby (hello, Child Tax Credit).

- Bought your first home (mortgage interest deductions can apply).

- Started a side hustle (yes, even if it’s “just for fun money”).

These life moves often flip your tax situation from “simple” to “needs a real look.”

Bottom Line

If you’re working, side hustling, or navigating big life changes, odds are you should file. And even if you technically don’t have to, you probably want to — because that’s how you get refunds and credits.

👉 General info only — confirm with IRS guidance or a tax pro.

Ready to Make It Easy?

Don’t spend hours googling filing thresholds. Let us take it off your plate.

Book your tax return in 2 minutes → makeadultingeasier.com/book