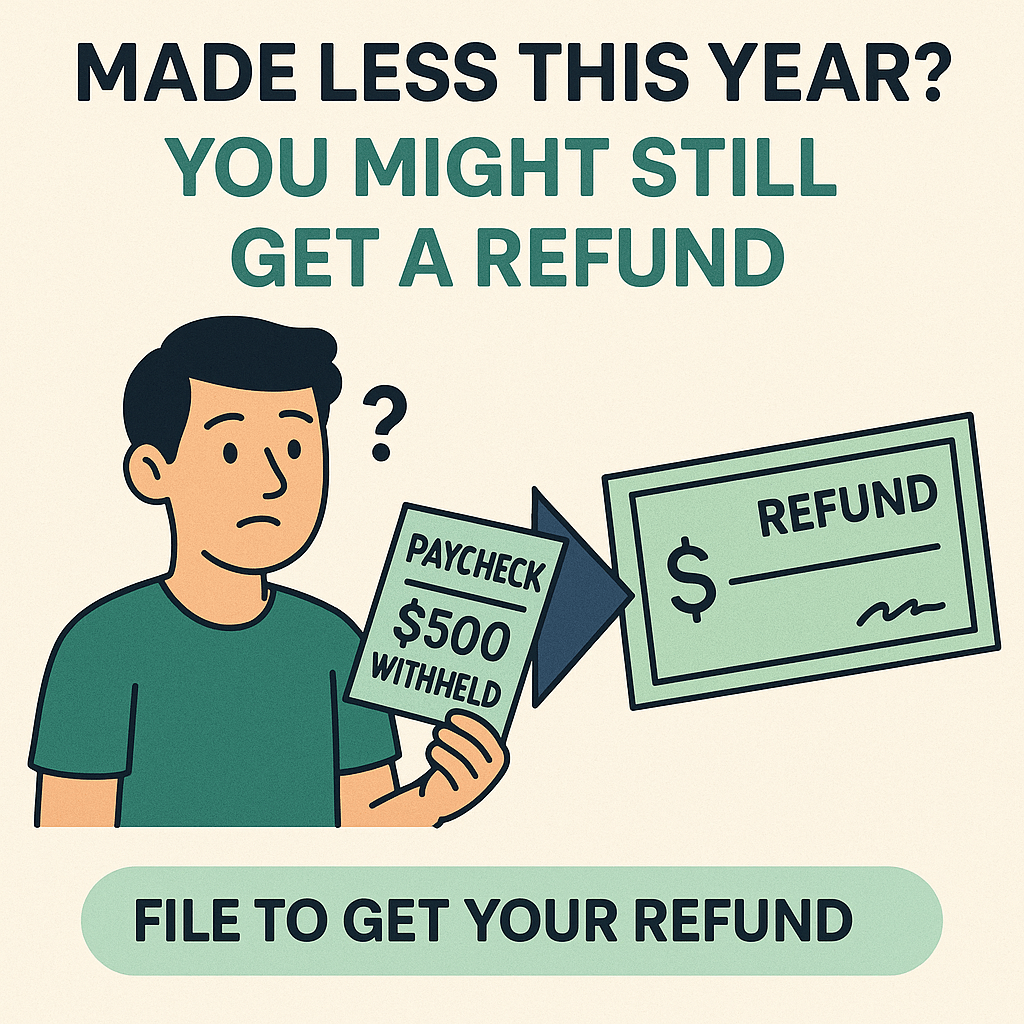

A lot of first-time filers think: “I barely worked, so I don’t need to file.” Sometimes that’s true. But here’s the kicker—filing could actually put money back in your pocket.

The IRS Filing Threshold

The IRS sets an income level each year that decides if you’re required to file a return. It depends on things like:

- Your filing status (single, married, etc.)

- Your age

- Your gross income (total income before deductions)

If you earned less than the threshold, technically you might not have to file.

Why You Might Want to File Anyway

Even if you’re under the threshold, you could be leaving money on the table by skipping your return:

- Refund of taxes withheld: If your paycheck had federal taxes taken out, you only get that money back if you file.

- Tax credits: You may qualify for refundable credits like the Earned Income Credit (EIC) or the American Opportunity Tax Credit (for students). These can give you a refund even if you didn’t owe taxes.

- State refunds: Some states also require filing separately, and they might owe you money back.

Example: You worked part-time, made $6,000, and had $500 withheld. If you don’t file, the IRS keeps that $500. If you do, you likely get it all back.

Bottom Line

Even if you didn’t earn much, filing is often worth it—it could mean a refund check with your name on it.

👉 Not sure if you actually need to file this year? Skip the guesswork. Book a quick chat with one of our tax pros: makeadultingeasier.com/book

Disclaimer: General information only—confirm with current IRS guidance or a tax professional.