If you’ve ever wondered why some paychecks feel straightforward and others look like a math test, you’ve bumped into the W-2 vs. 1099 difference. It’s not just paperwork—it changes how your taxes work, what gets withheld, and whether you’re your own boss (or not).

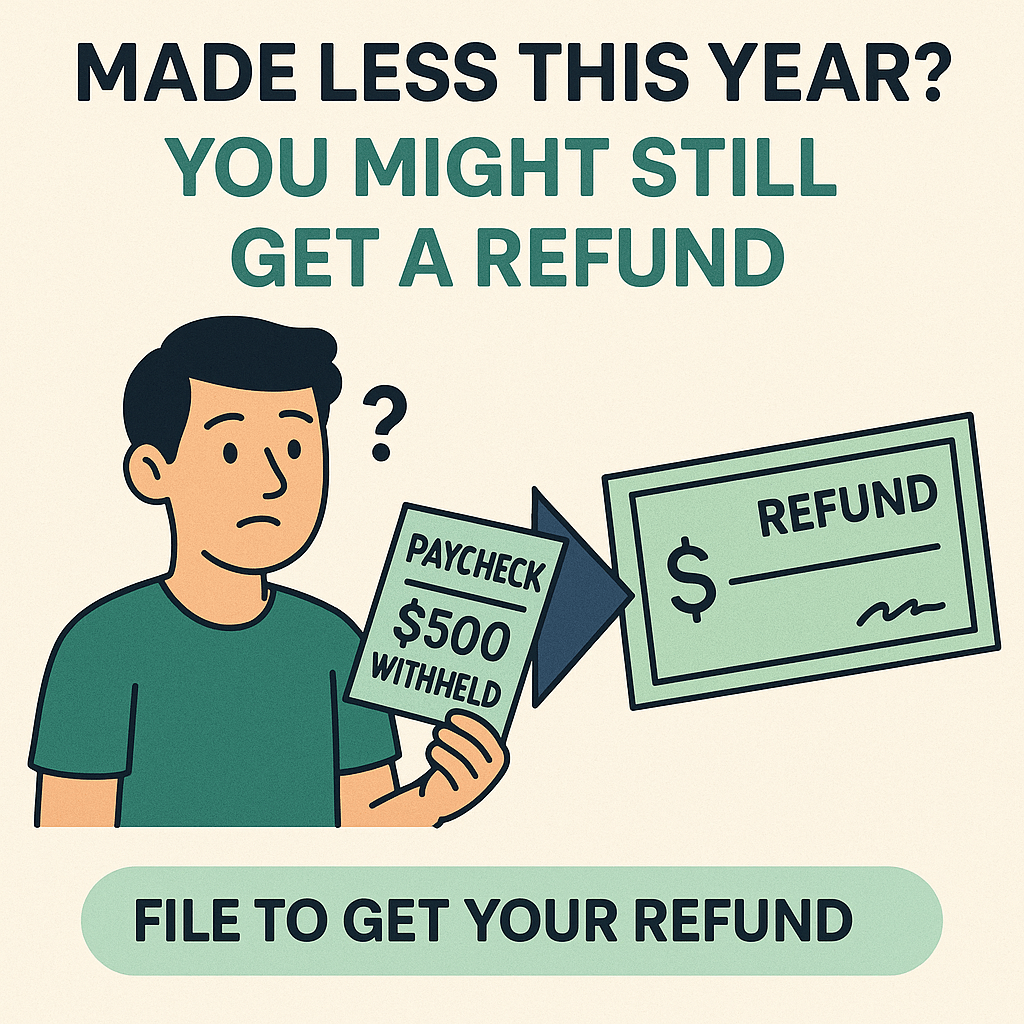

W-2: Classic Employee Life

When you’re a W-2 worker, you’re on payroll. Think 9–5 jobs, steady paychecks, and a boss who sends you Slack messages about “quick syncs.”

What it means:

- Taxes are withheld automatically (federal, state, Social Security, Medicare).

- You might get benefits like health insurance or a 401(k).

- You’ll receive a W-2 form in January that shows your total pay and how much was withheld.

In short: it’s structured, predictable, and your employer handles the messy tax math.

1099: Independent Hustler Life

A 1099 worker is self-employed or a contractor. Think Uber drivers, freelance designers, consultants, or anyone with a side hustle.

What it means:

- No taxes are withheld—you’re responsible for saving and paying them yourself.

- You’ll get a 1099-NEC (Nonemployee Compensation) if you earned $600+ from a client.

- You may need to pay quarterly estimated taxes.

- You can deduct business expenses (home office, mileage, supplies).

In short: more freedom, but also more responsibility.

The Big Differences (at a glance)

| Feature | W-2 Employee | 1099 Contractor |

|---|---|---|

| Taxes withheld | ✅ Yes | ❌ No |

| Benefits (health, 401k) | ✅ Often | ❌ Rare |

| Quarterly tax payments | ❌ No | ✅ Yes |

| Business expense deductions | ❌ Limited | ✅ Many |

| Stability | ✅ Steady paycheck | ❌ Income varies |

Why It Matters for You

- W-2 only? Taxes are simpler—just file your W-2 and you’re done.

- 1099 side hustle + W-2 job? Things get more complex: you may owe extra taxes, but you also unlock deductions.

- 1099 only? You’re running a mini business (whether you meant to or not).

Bottom Line

W-2 means “employee with built-in tax handling.” 1099 means “independent worker who’s their own payroll department.” Many young adults today juggle both—hello, paycheck and side hustle.

(General information only—confirm with current IRS guidance or a tax professional.)

👉 Not sure how your W-2 + 1099 income adds up? Book your return in 2 minutes — skip the stress