Congrats — you bought a home! That’s a huge step (and a lot of paperwork). But here’s the good news: being a homeowner also comes with potential tax deductions that can save you money.

Let’s walk through the ones you don’t want to overlook.

Mortgage Interest Deduction

If you’ve got a mortgage, chances are your biggest deduction will be the interest you pay on that loan. Your lender should send you a Form 1098 showing how much you paid.

Property Taxes

Those local property tax bills? Painful, yes. Deductible, also yes — at least up to certain IRS limits.

Points Paid at Closing

If you paid “points” (extra upfront money to lower your mortgage rate), you may be able to deduct some or all of that amount.

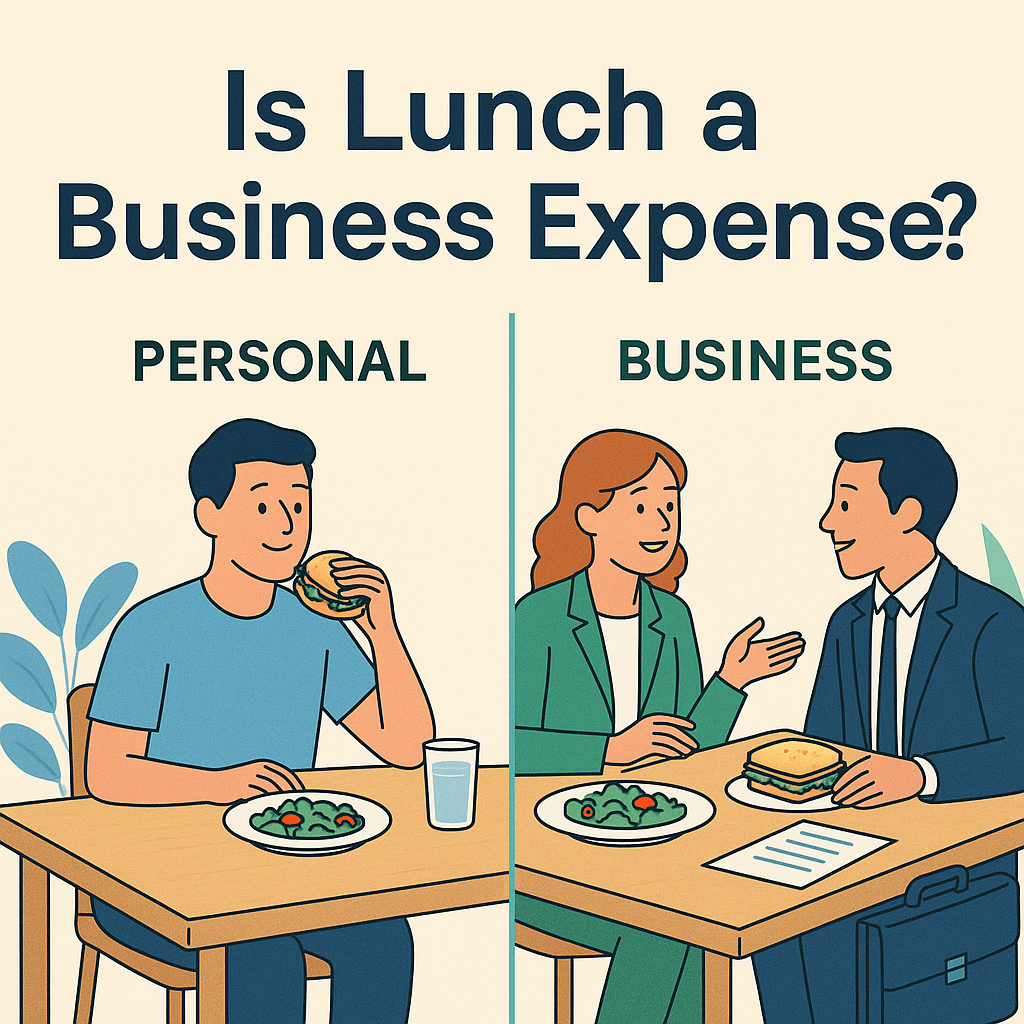

Home Office (If You Qualify)

Have a side hustle and use a dedicated room for work? You may be able to claim a home office deduction. (Sorry, your couch doesn’t count.)

Energy-Efficient Upgrades

Solar panels, new windows, or certain energy-efficient improvements may qualify for credits — a different but just-as-useful kind of tax break.

Pro Tip: Stay Organized from Day One

Mortgage interest forms, property tax bills, and upgrade receipts add up fast. Instead of digging through drawers in April, use our free Expense Tracker:

- Snap and upload receipts instantly

- Log property tax and mortgage docs in one spot

- Share securely with your tax pro (us!) for faster, smoother filing

Bottom Line

Owning a home can mean big savings at tax time — if you know what to look for (and if you keep the paperwork straight). Don’t leave money on the table.

👉 Let us help you find every deduction you qualify for. Book in 2 minutes → makeadultingeasier.com/book

General information only — confirm with current IRS guidance or a tax professional.