Taxes, money, and grown-up stuff — made simple.

2025 Tax Article Library

Why Did Someone Ask You for a W-9?

Got asked for a W-9? Don’t panic. Learn why, what it means for your taxes, and how to handle it. Book a tax pro today.

Is Lunch on the Job a Business Expense? Here’s the Truth

Out for lunch on the job? Find out when meals count as business expenses and when they don’t. Track receipts easily with our free tool.

Do I Have to File Taxes If I Didn’t Make Much Money?

Think you made too little to file taxes? You might still get a refund for withheld taxes or credits. Don’t miss out—book with a tax pro today.

Can My Parents Still Claim Me as a Dependent?

Wondering if your parents can still claim you? Learn the rules for students, income, and support. Avoid IRS mix-ups—book with a tax pro today.

Real Tax Breaks vs. Fake Internet Loopholes

Forget fake internet tax hacks. We compare viral “loopholes” with real credits and deductions that actually save you money. Book with a pro today.

What Happens If You Try the Sovereign Citizen Tax Strategy

Thinking of skipping taxes with a “sovereign citizen” strategy? Here’s what really happens—penalties, collections, and stress. Stay safe with a pro.

Do Billionaires Pay Taxes?

Billionaires play by different tax rules. Here’s why—and what credits & deductions actually matter for you. Book your return today.

Top 5 Tax Myths We See Online (and What’s Actually True)

We bust 5 common tax myths spreading online—from “cash isn’t income” to “skip filing.” Learn the truth and file smarter with a pro.

Top 5 Tax Myths on TikTok (and the Truth Behind Them)

Don’t fall for viral TikTok tax hacks. We bust 5 common myths and show you the real rules. Keep more money—book with a pro today.

Do I Have to File Taxes?

Not sure if you need to file taxes? Learn the 2024 IRS thresholds, key life events, and why filing could mean refunds. Book a tax pro today.

How to Fill Out a W-4 (and What It Actually Is)

Learn what a W-4 form is and how to fill it out step by step. Adjust your withholding, avoid surprises, and keep more of your paycheck.

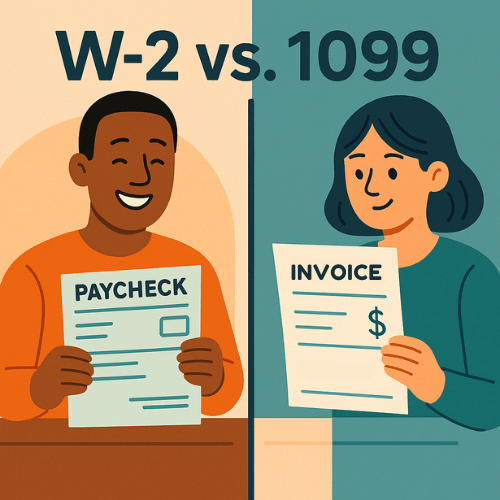

W-2 vs. 1099: What’s the Difference?

Learn the difference between W-2 employees and 1099 contractors. Taxes, benefits, and side hustle tips—explained simply. Book your return today.

What Is the Standard Deduction?

Learn how the standard deduction lowers your taxable income. Simple breakdown + when to itemize. Book your tax return today!

Hobby vs. Business — The IRS Line

The IRS treats hobbies and businesses differently. Here’s how creators know if their side hustle qualifies for deductions.

Can Influencers Deduct Makeup, Clothes, or Travel?

Props, costumes, and business travel might be deductible! Here’s what influencers can actually write off.

Can Gamers Deduct Consoles, PCs, and Streaming Gear?

If you earn income from Twitch or YouTube Gaming, some gear may be deductible. Here’s what qualifies—and what doesn’t.

Are Ring Lights and Camera Gear Deductible for TikTok?

If you earn money on TikTok or Instagram, certain gear may be deductible. Here’s what counts—and what the IRS says doesn’t.

Can OnlyFans Creators Deduct Expenses on Taxes?

If you earn income from OnlyFans, certain expenses may be deductible. Here’s what counts as a write-off—and what the IRS won’t allow.

Can You Deduct Work Clothes on Taxes?

Just because you only wear it to work doesn’t mean it’s deductible. Here’s the truth about work clothes and laundry expenses.

Home Office Deduction Myths: What the IRS Really Allows

Do you need a separate room for a home office deduction? Here’s what actually qualifies and how to claim it correctly.

Can You Write Off Your Wedding? IRS Rules Explained

Weddings are pricey—can you deduct the cost on your taxes? Here’s what the IRS allows and how to find real tax breaks after marriage.

Is Medical Marijuana a Tax Deduction? IRS Rules Explained

Marijuana may be legal in your state, but can you deduct it on your taxes? Here’s what the IRS says—and what medical costs actually qualify.

Can You Deduct Your Dog as a Comfort Animal?

Can your emotional support dog be a tax write-off? Here’s what the IRS says—and what pet expenses may actually qualify.

First Apartment or House? Rent, Mortgage, and Your Taxes

First apartment or house? Learn how rent and mortgages affect your taxes. Simple breakdown + pro tips. Book a tax pro today.

How to Keep Receipts from Disappearing Like Socks in the Dryer

Receipts vanish like socks in the dryer—don’t let them cost you money. Smart tips for storing, scanning, and saving what you need.

Summer Gig Season: How to Handle Short-Term Side Hustles

Doing short-term summer side hustles? Learn what counts as income, tax traps, and easy tips to stay on top of it. Book with a tax pro today.

First Time Itemizing? How to Decide If It’s Worth It

Wondering if itemizing beats the standard deduction? Learn what counts, pros and cons, and when it’s worth it. Book a tax pro today.

Filing Jointly vs. Separately: Pros and Cons for Newlyweds

Newly married? Learn the pros and cons of filing jointly vs. separately. Avoid surprises, save money, and choose the best option with a tax pro.

Back-to-School Season: Don’t Forget Education Tax Credits

Don’t miss out on education tax credits. Learn how AOTC and LLC can save you money this school year. Book with a tax pro today.

Dependents Explained: Who Qualifies and Who Doesn’t

Not sure who counts as a dependent? Learn the rules for kids, relatives, and who doesn’t qualify. Save money, avoid mistakes, book help today.

Do You Need to File State Taxes? (Spoiler: Probably)

Most people must file state taxes too—not just federal. Learn the rules, traps, and when you’re off the hook. Book help today.

Bought Your First Home? Here’s What It Means for Your Taxes

Bought your first home? Learn how mortgage interest, property taxes, and deductions affect your return. Book a pro → makeadultingeasier.com/book

Bought a Car for Work? What Counts as a Deduction

Bought a car for work? Learn what counts as a tax deduction for business driving vs. commuting. Book help with Make Adulting Easier.

Best Apps for Tracking Side Hustle Income (and the One That Saves You the Most Stress)

Side hustle income adds up fast. Here are the best apps to track earnings and expenses so tax time is stress-free. Book a pro today.

What to Do If You Get a 1099 in January (and How to Stay Organized)

Got a 1099 in the mail? Learn what it means, steps to take, and how to avoid surprises at tax time. Book a pro today.

“Wait, I Owe Taxes?” Why That Happens and How to Avoid It

Thought you’d get a refund but ended up owing taxes? Learn why it happens and how to avoid it next year. Book a tax pro today.

The Child Tax Credit in Plain English

Kids under 17? You may qualify for the Child Tax Credit. Learn what it is, who qualifies, and how it works. Book a tax pro today.

Tax Breaks for Green Upgrades: Solar, Windows, and More

Solar panels, windows, HVAC — going green can lower your tax bill. Learn what upgrades qualify for credits. Book a tax pro today.

Student Loan vs. Tuition Deduction: What’s the Difference?

Student loans and tuition aren’t treated the same at tax time. Learn the difference between deductions and credits. Book a tax pro today.

Medical Expenses That May Be Deductible (Even Glasses!)

From doctor bills to prescription glasses, learn which medical expenses may be tax-deductible. Book a tax pro today.

Homebuyer Deductions You Don’t Want to Miss

New homeowner? From mortgage interest to property taxes, here are key deductions you don’t want to miss. Book a tax pro today.

Daycare, Babysitters, and Summer Camp: What’s Deductible?

Daycare? Babysitters? Summer camp? Learn what childcare costs count for tax credits and which don’t. Book a tax pro today.

Charitable Donations: No, Venmo to a Friend Doesn’t Count

You’re generous. You tip well, help friends move, and maybe even covered your buddy’s brunch once or twice. But here’s the thing: not all “good deeds” qualify as charitable donations on your taxes. Let’s clear up what actually counts — and what doesn’t. What Counts as...

Can You Deduct That Side Hustle Expense? A Quick Guide

Not sure which side hustle costs are tax-deductible? Learn what counts, what doesn’t, and how to save time (and money). Book a pro today.